All Land

Discover the latest land for sale

RM 40,000,000

RM 110,000

RM 90,000

RM 1,389,706

Lot Banglo Geran Individu Saujana impian untuk dijual

Lot Banglo Geran Individu Saujana impian untuk dijual

RM 550,000

RM 1,350,000

RM 2,100,000

BUNGALOW Desa Pinggiran Bayu Near Presint 17 Putrajaya

BUNGALOW Desa Pinggiran Bayu Near Presint 17 Putrajaya

RM 414,180

RM 140,000

RM 4,295,227

BUNGALOW LOT PUTRA HILL RESIDENCY BANDAR SERI PUTRA BANGI

Jalan Seri Putra 6/5, 43000, Selangor

RM 460,000

RM 515,000

Have land to sell or want to buy land now?

Let IQI's trained professionals help you now

Learn

Tips and Guides

Stamp Duty Malaysia 2025: What You Need to Know!

Stamp Duty Malaysia 2025: What You Need to Know!

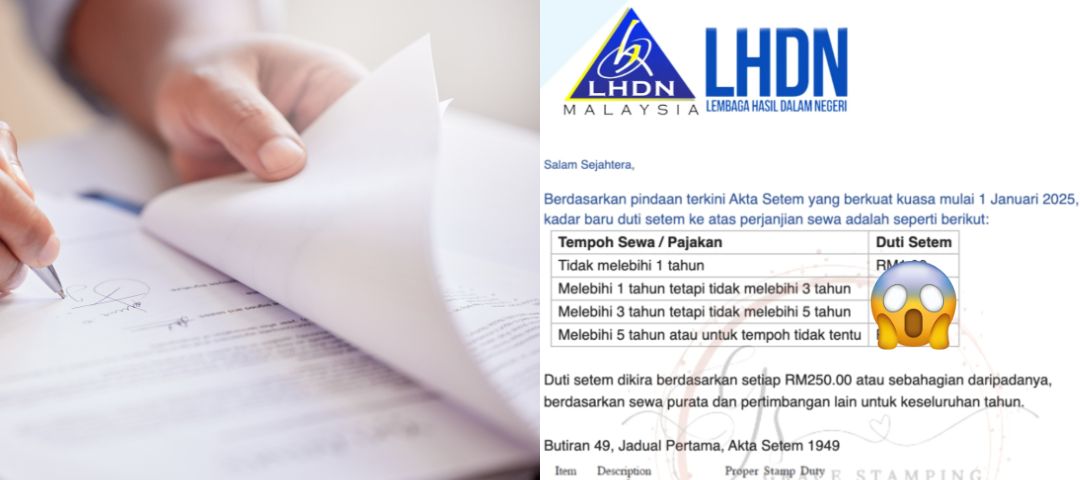

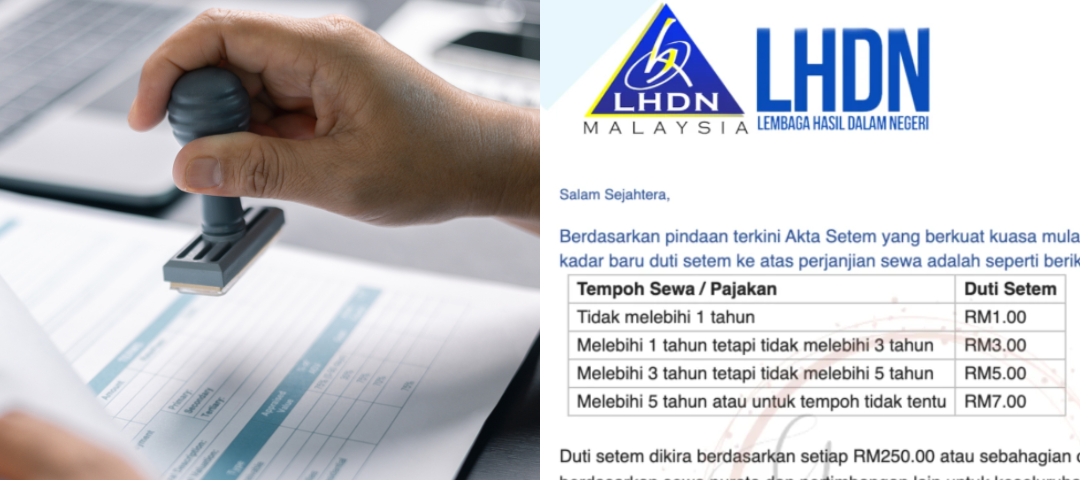

Version: CN, BMAre you feeling lost in the maze of stamp duty or property transaction costs in Malaysia?The ever-changing rules and calculations surrounding stamp duty can feel overwhelming, leaving you anxious about making a costly mistake. But fear not! This comprehensive guide will demystify stamp duty, providing you with the clarity and confidence to navigate your property journey in Malaysia.Stamp Duty Malaysia1. Understanding Stamp Duty2. Why Should You Care About Stamp Duty?3. The Different Shades of Stamp Duty: Ad Valorem and Fixed Duties4. Who Foots the Bill? Determining Liability for Stamp Duty5. Stamp Duty Rates on Instruments of Transfer in Malaysia (2025)6. Stamp Duty on Loan Agreements7. Stamp Duty Exemptions and Remissions in Malaysia8. Stamp Duty on Tenancy Agreements (NEW)9. Paying Your Stamp Duty: The STAMPS System10. Deadlines and Penalties for Late Stamping (NEW)11. Significant Changes to Stamp Duty in 2025 and Beyond12. Frequently Asked Questions (FAQs) about Stamp Duty in Malaysia:1. Understanding Stamp DutyStamp duty is a tax levied on legal documents, specifically those related to the purchase or transfer of real estate, as well as tenancy, etc. in Malaysia. It's governed by the Stamp Act 1949 and overseen by the Lembaga Hasil Dalam Negeri Malaysia (LHDN), the Inland Revenue Board of Malaysia.Think of it as a mandatory fee that validates your property-related documents, making them legally binding and admissible in court. It is not merely a formality but a cornerstone of secure and legal property transactions.2. Why Should You Care About Stamp Duty?Understanding stamp duty is not just about ticking a legal box but making informed decisions. No matter you're a first-time homebuyer, a seasoned investor, or simply transferring property to a loved one, knowing the ins and outs of stamp duty can save you significant sums of money and prevent legal headaches down the road. It directly impacts your financial planning and ensures a smooth, legally sound property transaction.3. The Different Shades of Stamp Duty: Ad Valorem and Fixed DutiesIn Malaysia, stamp duty comes in two primary forms:Ad Valorem Duty: This is the most common type for property transactions. The amount payable is calculated as a percentage of the property's value or the consideration stipulated in the instrument, whichever is higher. The higher the property value, the higher the stamp duty, although there are some exemptions that we will discuss later.Fixed Duty: This type of duty applies a predetermined amount, regardless of the property's value. It's typically levied on specific legal documents, such as certain types of agreements, as outlined in the First Schedule of the Stamp Act 1949.4. Who Foots the Bill? Determining Liability for Stamp DutyThe responsibility for paying stamp duty isn't arbitrary. The Third Schedule of the Stamp Act 1949 clearly outlines who is liable for specific instruments. In most property transactions, the buyer is responsible for paying the stamp duty on the instrument of transfer (MOT) and SPA.The borrower is responsible for paying the stamp duty on the loan agreement.5. Stamp Duty Rates on Instruments of Transfer in Malaysia (2025)The cost of stamp duty on the transfer of property, excluding shares, stock, or marketable securities, depends on whether the buyer is a Malaysian citizen/permanent resident or a foreigner/foreign company.a. For Malaysian Citizens and Permanent Residents:Price TierStamp Duty RateFirst RM100,0001%RM100,001 to RM500,0002%RM500,001 to RM1,000,0003%Above RM1,000,0004%Source: iProperty Malaysiab. For Foreign Companies, Non-Citizens, and Non-Permanent Residents:Price TierStamp Duty RateAll Price Tiers4%Source: PwCc. Example CalculationLet's say you're a Malaysian citizen buying a property for RM600,000. Here's how the stamp duty is calculated:First RM100,000: RM100,000 x 1% = RM1,000Next RM400,000: RM400,000 x 2% = RM8,000Remaining RM100,000: RM100,000 x 3% = RM3,000Total Stamp Duty: RM1,000 + RM8,000 + RM3,000 = RM12,0006. Stamp Duty on Loan AgreementsWhen you take out a loan to finance your property purchase, the loan agreement is also subject to stamp duty.a. Standard RateGenerally, a flat rate of 0.5% of the total loan amount applies.b. Reduced RateFor specific Malaysian Ringgit loan agreements or instruments without security and repayable on demand or in a single bullet repayment, a reduced rate of 0.1% may apply.c. Example CalculationIf you take out a loan of RM540,000 (90% of the RM600,000 property), the stamp duty on the loan agreement would be:RM540,000 x 0.5% = RM2,7007. Stamp Duty Exemptions and Remissions in MalaysiaFortunately, the Malaysian government offers several exemptions and remissions to ease the financial burden of stamp duty, particularly for first-time homebuyers and specific property transfers.a. First-Time Homebuyers Exemption (i-MILIKI):This initiative aims to encourage homeownership among Malaysians.Properties valued up to RM500,000: Full stamp duty exemption on both the instrument of transfer and loan agreement. This applies to Sale and Purchase Agreements executed between 1 January 2021 and 31 December 2025.Properties valued between RM500,001 and RM1,000,000: 75% stamp duty exemption on the instrument of transfer for SPAs executed by December 31, 2023. Starting from 2024, first-time homebuyers purchasing homes above RM500,001 will not benefit from any stamp duty exemption.b. Eligibility Criteria for First-Time Homebuyers Exemption:Malaysian citizen.Must not already own a residential property (including inherited or gifted property).Applicable to residential properties only (excluding SOHO/SOFO/SOVO types and serviced residences built for commercial use).c. Transfer Between Family Members:Parent and Child:Before April 1, 2023: 50% remission of stamp duty.From April 1, 2023: Full exemption for the first RM1 million of the property's value; 50% remission on the ad valorem stamp duty for the remaining value. This applies only to Malaysian citizens.Grandparent and Grandchild: From April 1, 2023: Full exemption for the first RM1 million of the property's value; 50% remission on the ad valorem stamp duty for the remaining value. This applies only to Malaysian citizens.Husband and Wife: 100% exemption.Siblings: No exemption.d. Other Exemptions and Remissions:Abandoned Housing Projects: Stamp duty exemption on instruments executed by a rescuing contractor or developer approved by the Ministry of Housing and Local Government, for loan agreements and transfer of revived residential properties in abandoned projects. This exemption is valid for instruments executed by December 31, 2025.Conversion of Conventional Partnership or Private Company to Limited Liability Partnership: Stamp duty exemption on all instruments of transfer of land, business, asset, and share.Micro Small and Medium Enterprises (MSMEs):Stamp duty exemption on loan/financing agreements executed between MSMEs and investors for funds raised on a peer-to-peer platform registered and recognized by the Securities Commission (SC). This is valid from January 1, 2022, to December 31, 2026.Stamp duty exemption on instruments for loan or financing up to RM50,000 (increased to RM100,000 for agreements executed from January 1, 2025) between MSMEs and participating banks or financial institutions under the National Small and Medium Enterprise Development Council.Stamp duty exemption on loan or financing instruments executed from January 1, 2025 to December 31, 2026 by MSMEs and investors through Initial Exchange Offering platforms registered with SC.e. Stamp Duty Order (Remittance & Exemption):You can check out the various stamp duty order for remittance & exemption from year 2002 until 2021 on LHDN Malaysia official website.8. Stamp Duty on Tenancy Agreements (NEW)When it comes to rental properties, stamp duty is calculated based on the monthly rental and the duration of the tenancy. As of January 1, 2025, the new rates for stamp duty on rental agreements are as follows:Rental PeriodStamp DutyNot exceeding 1 yearRM1.00Exceeding 1 year but not exceeding 3 yearsRM3.00Exceeding 3 years but not exceeding 5 yearsRM5.00Exceeding 5 years or for an indefinite periodRM7.00Source: 小晴天~房产报报看Stamp duty is calculated based on every RM250.00 or part thereof, depending on the average rent and other considerations for the entire year.a. Example Calculation (Based on old calculation):Let's say you're renting a property for RM1,800 per month for 3 years.Calculate Annual Rent: RM1,800 x 12 months = RM21,600Subtract the Exemption Threshold (if applicable): RM21,600 - RM2,400 = RM19,200 (The RM2,400 threshold is no longer applicable as of January 1, 2025)Divide by RM250 and Round Up: RM21,600 ÷ RM250 = 86.4, rounded up to 87Multiply by the Applicable Rate (RM3 for 3-year tenancy, based on old rates): 87 x RM3 = RM261Add Stamp Duty for Tenant's Copy: RM261 + RM10 = RM271b. Important NoteThe tenant is responsible for paying the stamp duty on the tenancy agreement, not the landlord.9. Paying Your Stamp Duty: The STAMPS SystemGone are the days of manually stamping documents at the LHDN office. Now, you can conveniently pay your stamp duty online through the Stamp Assessment and Payment System (STAMPS) via the LHDN website (https://stamps.hasil.gov.my).This digital system streamlines the process, making it faster and more efficient.a. Step-by-Step Guide to Paying Stamp Duty Online via STAMPS:Register as a STAMPS User: If you are not already registered, create an account on the STAMPS portal.Log in to STAMPS: Access the system using your registered ID and password.Select "Sistem Duti Setem": Choose the stamp duty system from the available options.Choose "Penyeteman" and then select the type of instrument: For example, select "Perjanjian Sewa" for tenancy agreement and "Pindah Milik Tanah/ Harta" for the instrument of transfer (e.g., MOT).Fill in the Required Information: Provide details about the instrument, property, and parties involved.Upload Supporting Documents: You may need to upload scanned copies of the relevant documents (e.g., SPA, loan agreement, tenancy agreement).Make Payment: Pay the stamp duty online using FPX or other available online payment methods, such as CIMB BizChannel and Public Bank.Print Stamp Certificate: Once the payment is successful, you can print the stamp certificate. Affix this certificate to the original instrument as proof of payment.b. Important NoteA stamp certificate is issued electronically for online applications through STAMPS. The certificate should be affixed or attached to the instrument, and the instrument is considered duly stamped.10. Deadlines and Penalties for Late Stamping (NEW)It's crucial to pay stamp duty within the stipulated timeframe to avoid penalties.Instruments executed within Malaysia: Must be stamped within 30 days of execution.Instruments executed outside Malaysia: Must be stamped within 30 days after it has been first received in Malaysia.a. Penalties for Late Stamping (Effective from January 1, 2025):DelayPenaltyNot exceeding 3 monthsRM50 or 10% of the unpaid stamp duty, whichever is higherExceeding 3 monthsRM100 or 20% of the unpaid stamp duty, whichever is higherSource: 小晴天~房产报报看, The Sunb. Before January 1, 2025, the old penalty rates are:DelayPenaltyNot exceeding 3 monthsRM25 or 5% of the unpaid stamp duty, whichever is higherExceeding 3 months, not exceeding 6 monthsRM50 or 10% of the unpaid stamp duty, whichever is higherExceeding 6 monthsRM100 or 20% of the unpaid stamp duty, whichever is higherSource: LHDN Malaysia, Cleartax, 小晴天~房产报报看c. Consequences of Unstamped or Insufficiently Stamped Instruments:Inadmissible in Court: The document will not be accepted as evidence in a court of law.Cannot Be Acted Upon by Public Officer: A public officer will not act upon an unstamped or insufficiently stamped instrument.11. Significant Changes to Stamp Duty in 2025 and BeyondThe Malaysian government is implementing significant changes to the stamp duty regime, transitioning towards a self-assessment system.a. Key ChangesMandatory Stamping: From 2026, stamp duty will be mandatory for all instruments under the Stamp Act, including intercompany agreements.Self-Assessment System: This will be implemented in phases:Phase 1 (from January 1, 2026): Rental or lease, general stamping, and securities.Phase 2 (from January 1, 2027): Instruments of transfer of property ownership.Phase 3 (from January 1, 2028): All other instruments not covered in Phases 1 and 2.IRB Audit Power: The IRB will have the authority to audit agreements up to five years after the duty is paid or would have been paid.Increased Penalties: The maximum penalty is RM100 or 20% of the deficient duty, whichever is higher. If the matter goes to court, the fines can range from RM1,000 to RM10,000, and may have to pay a special penalty equivalent to the underpaid duty.b. Expert InsightsSource: KPMG"The amendments will make stamp duty mandatory and grant the Inland Revenue Board (IRB) the authority to audit agreements up to five years after payment," says Soh Lian Seng, Head of Tax at KPMG in Malaysia. He further emphasizes the importance of accurate calculations and classifications under the self-assessment system to avoid hefty penalties.12. Frequently Asked Questions (FAQs) about Stamp Duty in Malaysia:a. How much is stamp duty in Malaysia 2025?The stamp duty rates for property transfers in 2025 depend on the property value and the buyer's status (Malaysian citizen/permanent resident or foreigner). For Malaysian citizens and permanent residents, the rates are tiered: 1% for the first RM100,000, 2% for the next RM400,000, 3% for the next RM500,000, and 4% for the value exceeding RM1,000,000. For foreigners and foreign companies, a flat rate of 4% applies. For loan agreements, the general rate is 0.5% of the loan amount. Tenancy agreement stamp duty rates have also changed - refer to the "Stamp Duty on Tenancy Agreements" section above.b. Is there any stamp duty exemption for first-time homebuyers in 2025?Yes, first-time homebuyers purchasing properties valued up to RM500,000 can enjoy a full stamp duty exemption on both the instrument of transfer and loan agreement if the SPA is executed between January 1, 2021, and December 31, 2025. However, for properties valued between RM500,001 and RM1,000,000, the 75% exemption on the instrument of transfer was only valid for SPAs executed by December 31, 2023.c. What are the stamp duty rates for properties in Malaysia 2025?The rates are the same as mentioned in question 1. Refer to the tables provided in the "Stamp Duty Rates on Instruments of Transfer" section above.d. How to calculate stamp duty on a loan agreement in Malaysia 2025?The stamp duty on a loan agreement is generally 0.5% of the total loan amount. For example, if you take out a loan of RM450,000, the stamp duty would be RM2,250. However, certain exceptions and reduced rates may apply as mentioned in the "Stamp Duty on Loan Agreements" section.e. Is there any change in stamp duty in Malaysia 2025?Yes, there are several changes, including the introduction of a self-assessment system, mandatory stamping for all instruments under the Stamp Act (from 2026), increased audit powers for the IRB, revised penalty rates for late stamping, and changes to stamp duty rates for tenancy agreements.f. What documents are subject to stamp duty in Malaysia?Documents related to the sale, transfer, and lease of property, loan agreements, and other instruments listed in the First Schedule of the Stamp Act 1949 are subject to stamp duty. This includes Sale and Purchase Agreements (SPA), Memorandum of Transfer (MOT), Deed of Assignment (DOA), Loan Agreements, and Tenancy Agreements.g. How to pay stamp duty online in Malaysia LHDN?You can pay stamp duty online through the Stamp Assessment and Payment System (STAMPS) on the LHDN website (https://stamps.hasil.gov.my). You need to register as a user, log in, select the type of instrument, fill in the required information, upload supporting documents, and make the payment online.Stamp duty is an integral part of property transactions in Malaysia. Understanding its nuances, from rates and calculations to exemptions and payment procedures, is crucial for a smooth and cost-effective property journey. By staying informed about the latest regulations and leveraging available exemptions, you can navigate the complexities of stamp duty with confidence and make informed decisions that safeguard your financial well-being. Remember, this guide serves as a starting point, please always consult with legal and financial professionals for personalized advice tailored to your specific circumstances. The upcoming changes in 2025 and beyond underscore the importance of staying updated and seeking expert guidance to ensure compliance and optimize your property transactions in Malaysia.Are you a first-time homebuyer or need expert guidance on purchasing a house? We are here to assist you! Fill out the form below, and our representative will approach you soon![hubspot portal="5699703" id="1fb1e99c-d47d-4376-8656-d6d386e92960" type="form"]Continue Reading:ALERT: IQI Does Not Operate “IQI Capital Solutions”.IQI Expands Into The Mediterranean Sea With IQI Montenegro.Juwai IQI Predicts 5% Growth in Malaysia’s 2025 Foreign Investment Residential Sector.Citation, Reference and Related Information about Stamp Duty in Malaysia 2025LHDN MalaysiaStamp Duty2. iProperty MalaysiaMemorandum of Transfer (MOT) and Stamp Duty in Malaysia.Sale and Purchase Agreement in Malaysia: What is SPA in property?Stamp duty and legal fees calculation for SPA when buying a house in Malaysia.3. PwC2024/2025 Malaysian Tax Booklet: Stamp Duty.4. CleartaxStamp Duty in Malaysia: Rates, Exemptions & Penalties.5. DWG MalaysiaWhat is Memorandum Of Transfer (MOT) in Malaysian Property?6. 小晴天~房产报报看How to calculate the new stamping fee 2025!Year 2025 | Late stamping fine adjustment.7. Propertyguru MalaysiaTenancy Agreement In Malaysia: 6 Things You Should Know!8. The SunTax Matter - Expect significant Changes to Stamp Duty from 2025.9. KPMGTax experts: Stamp duty reform must come with stronger enforcement, stiffer penalties

Read more

简单10个步骤,让你轻松出租房子!

简单10个步骤,让你轻松出租房子!

在马来西亚,房地产是最热门的投资类型之一。除了很多有能力的人,买了一套房自住后,也会再买第二套房用于出租,每个月稳定赚取租金,创造被动收入。当然,也有一些投资者,会将多余的空房出租,并通过出租房间的租金,偿还每月的房屋贷款。不过,要将房子出租,确实有许多事情需要处理和操心。而以下10个步骤,能帮助你轻松出租房子哦!阅读内容:1. 调查市场行情2. 美化房子,准备带人看房3. 寻找房地产中介帮忙4. 筛选合适的租客,协调租房条件5. 签署租房献议书和收取定金6. 签署租房合同7. 向租客收取租房合同印花税和租房抵押金8. 购买房东保险(Landlord Insurance )9. 租客入住前准备10. 开始你的收租生活1. 调查市场行情在你将房子出租前,必须先了解市场上的租金行情。你可以到各大租房网站看看,如IQI Global,或是询问房地产中介,了解目前市场租金水平和竞争情况,如:同类单位是否提供家具;租金是否包括水电费(包与不包的差价);收取多少定金、保证金和抵押金;目标地区的租房数量;目标地区的租客类型(年龄、职业、国籍或种族等)等等。了解市场情况后,你可以大概了解谁是目标租客群,从而决定是否提供家具电器等。综合所有情况后,再以当前市场的租金水平,设定一个既有吸引力又不违背租赁生意道德,还能为你带来满意的租金回报率的合理租金。2. 美化房子,准备带人看房人家说,卖房前美化房子,可以提高房子的吸引力,给买家留下好印象,最后或许还能卖到好价格。出租房子也是一样,把房子打扫干净并布置好,向潜在租客展现整洁漂亮的房子,不但可以提高出租成功率,还有机会租个好价钱呢!如果你打算为房子增添家具或进行装修,尽可能在租客看房前完成,以免让未来租客看到乱糟糟的家,而对你的房子失去兴趣。3. 寻找房地产中介帮忙 不要以为房地产中介只是帮客户买卖房子,他们都是受过专业训练,所有有关房子的事宜,都难不倒他们。如果你不太了解出租房子的程序,建议你让专业的房地产中介帮助你。从帮你的屋子打广告、寻找租客、看房、处理租房合约签约和盖章等,房地产中介都会帮你处理好,让你省去时间和精力。此外,他们还能给你专业又中立的出租建议,帮助你找到需要改进的地方,以让你更快地找到租客,出租房子。4. 筛选合适的租客,协调租房条件租客的素质非常重要,他们将决定你能否有稳定的收入来源。如果你找到一个准时交租、爱护房子的租客,那你就没有烦恼;要是你遇到不好的租客,你除了面临租金损失,还有精神上的折磨。那要如何筛选好租客呢?当潜在租客来看房时,你可以从见面交谈中了解他们,也要向租客表明你的租房条件:租金和抵押金入住日期日后维修责任等等另外,你可以通过信贷机构调查潜在租客的信用记录,以评估他们是否会拖欠租金。5. 签署租房献议书和收取定金来到这一步,首先恭喜你,你已经找到租客了!你和潜在租客双方都达成租房共识后,就能收取定金(一般为一个月的租金),并签署租房献议书(Letter of Offer to Rent)。这份献议书将阐明房东和租客的信息,以及保障双方权益的各项条款。不过,一旦租客支付定金后,没有在规定的时间内与房东签署租房合同,那房东有权利没收定金。6. 签署租房合同租房献议书(Letter of Offer to Rent)和定金的部分解决后,接下来就是签署租房合同(Tenancy Agreement)啦!这时候,你可以自行寻找律师帮忙准备租房合同,或让房地产中介帮你准备。租房合同的内容,主要是保障房东和租客的权益。由于马来西亚的租房合同目前没有统一规范,因此房东和租客可以随意增设对自己有利的条款。不过,作为房东,建议你在租房合同中包含以下条款:业主和租客的信息出租期限租金、保证金和水电押金数额收取租金的方式租客续约选项维修责任提早终止租约的条款所有家具、电器等物品清单其他特别条款请律师草拟租房合同,当然需要支付律师费。但是,租房合同的律师费怎么算呢?首先,要视乎你的租期是多少年。少于3年的租房合同律师费:月租金律师费费率首RM10,000每月租金的25%接下来的RM90,000每月租金的20%超过RM100,000可商议算法A算法B以RM10,000月租为例:RM10,000 X 25% = RM2,500以RM30,000月租为例首RM10,000 X 25% = RM2,500接下来RM20,000 X 20% = RM4,000总额:RM2,500 + RM4,000 = RM6,500租期超过3年的租房合同律师费:月租金律师费费率首RM10,000每月租金的50%接下来的RM90,000每月租金的20%超过RM100,000可商议算法A算法B以RM10,000月租为例:RM10,000 X 50% = RM5,000以RM30,000月租为例首RM10,000 X 50% = RM5,000接下来RM20,000 X 20% = RM4,000总额:RM5,000+ RM4,000 = RM9,000至于谁要承担这笔租房合同律师费?目前没有一项法律规定由租客或房东来承担,所以一般上,这笔律师费将由房东和租客共同承担。7. 向租客收取租房合同印花税和租房抵押金租约签好了,你以为这样就行了?不是的!这与买房时签署买卖协议(SPA)一样,当你和租客签署了租房合同后,就要拿到马来西亚内陆税收局(LHDN)盖章(stamping),才具有法律效力。这也意味着,你需要支付租房合同的印花税(stamp duty)。根据内陆税收局2025年最新的印花税税率,租房合同的印花税费用如下:租约期限印花税费用少于1年RM11年以上,但不足3年RM3超过3年,但不足5年RM5超过5年或以上RM7因此,你租房合同印花税的算法是这样的……以RM2,000月租、租期1年为例:1. RM2,000 x 12个月 = RM24,0002. RM24,000 / RM250 = RM963. RM96 X RM1 = RM96因此,你的租房合同印花税是RM96。通常租房合同有正本和副本,一份给房东,一份给租客,而这两份合同都必须到税收局盖章,才有法律效力。而副本的印花税为RM10,加上正本的RM96,你的印花税总额为:RM96 + RM10 = RM106那印花税的费用要由谁承担?根据《1949年印花税法令》第三附表列明,租房合同的印花税一般由租客支付。租房合同的程序完成后,你现在可以向租客收取租房保证金(security deposit)和水电抵押费(utility deposit)。这两笔费用通常分别为2个月和半个月的租金,以用作租客退租时的任何维修和清洁费用,以及偿还租客拖欠的水电费。8. 购买房东保险(Landlord Insurance)如果想要你房屋内的财产和租金收入有进一步的保障,你可以考虑购买一份房东保险。当你的房子被租客蓄意破坏而需要进行维修、租客无预警搬走、发律师信给不肯搬走的租客等情况下,房东保险都能为你提供赔偿。不同保险公司所推出的房东保险配套和费用都不同,你可以向各家保险公司询问,了解详情。9. 租客入住前准备在租客搬进来前,你需要依照租房合同内的协定交屋子,如把房子打扫干净、电器家具等都能正常使用。最后,你也要准备多一份备份钥匙,以免日后租客弄丢钥匙。10. 开始你的收租生活在交房子当天,作为房东的你,必须与租客一起做最后一次的房子检查,以确保所有东西是符合租房合同中所列明的状态。如果一切都没问题,那你从今以后就是包租公包租婆,每个月收租赚额外收入啦!出租房子也是房地产投资的一种,所以必须在设施配套齐全且方便的地点买房并出租,才能更有效地为你带来稳定的投资回报!打算出租房子,但想要寻找房地产中介的帮忙?IQI能帮助你!房地产科技公司IQI旗下拥有超过50,000名专业房地产中介,通过专业的培训后,能提供投资者专业的投资建议。赶快来获得咨询吧![hubspot portal="5699703" id="85ebae59-f425-419b-a59d-3531ad1df948" type="form"]延伸阅读:2025年租约印花税、延迟盖章罚款双双上涨!【附全新计算方式】快速出租房屋:你不可不知的5大技巧2024年Q2-Q3房屋租赁指数报告:租金上涨,下一个投资风口在哪?

Read more

Deposit Tetap : Bank Mana yang Menawarkan Kadar FD Terbaik Januari 2025?

Deposit Tetap : Bank Mana yang Menawarkan Kadar FD Terbaik Januari 2025?

Versi: EN , CN Mencari cara terbaik untuk mengembangkan simpanan anda dengan selamat? Januari 2025 membawa berita baik untuk anda!Dalam artikel ini, kami akan membongkar kadar faedah deposit tetap terbaik di Malaysia yang boleh membantu anda memaksimumkan pulangan pelaburan anda. Sama ada anda seorang pelabur berpengalaman atau baru bermula, panduan ini akan memberikan anda maklumat terkini dan promosi terbaik yang ditawarkan oleh bank-bank terkemuka. Jangan lepaskan peluang untuk mengetahui bagaimana anda boleh membuat wang anda bekerja lebih keras untuk anda!Panduan Anda untuk Simpanan Tetap + Kadar FD TerkiniApakah itu Deposit Tetap (FD) dan Deposit Tetap-i (FD-i)?Apakah itu Deposit Tetap (FD)?Apakah itu Deposit Tetap-i (FD-i)?Perbezaan Utama antara FD dan FD-i Kadar Deposit Tetap/FD terkini untuk Januari 20251. Alliance Bank2. CIMB Bank3. RHB Bank4. BSN5.Maybank6. OCBC BankApakah itu Deposit Tetap (FD) dan Deposit Tetap-i (FD-i)?Apakah itu Deposit Tetap (FD)?Deposit Tetap (FD) adalah seperti memasukkan wang anda ke dalam peti besi ajaib di bank. Jenis deposit ini dikenali kerana risiko yang rendah dan pulangan yang boleh diramalkan, menjadikannya pilihan menarik bagi pelabur yang konservatif. Tempoh pelaburan biasanya boleh berkisar dari beberapa bulan hingga beberapa tahun, dan kadar faedah yang diperoleh biasanya lebih tinggi berbanding dengan akaun simpanan biasa. Setelah tempoh matang, pendeposit akan menerima jumlah pokok bersama dengan faedah yang terkumpul. Selain itu, deposit tetap juga sering dilengkapi dengan pelbagai ciri seperti pilihan pengeluaran awal, yang mungkin dikenakan penalti, serta keupayaan untuk melaburkan semula faedah yang diperoleh. Secara keseluruhannya, deposit tetap berfungsi sebagai cara yang selamat untuk meningkatkan simpanan sambil memastikan pemeliharaan modal.Apakah itu Deposit Tetap-i (FD-i)?Deposit Tetap-i (FD-i) adalah produk simpanan yang mematuhi prinsip Syariah, menawarkan peluang kepada individu untuk menyimpan duit dengan cara halal dan mendapatkan pulangan. Ia beroperasi menggunakan kontrak seperti Mudharabah, di mana pemilik deposit (anda) memberikan wang kepada bank untuk diuruskan. Bank, sebagai pengurus, akan melaburkan wang tersebut dalam perniagaan yang dibenarkan oleh Syariah, dan keuntungan yang diperoleh akan dibahagikan antara anda dan bank berdasarkan nisbah yang telah dipersetujui. Anda boleh memilih tempoh simpanan, biasanya antara 1 hingga 60 bulan, dan semakin lama tempoh simpanan, semakin tinggi potensi keuntungan. Selepas tempoh matang, bank akan memberikan keuntungan yang telah ditetapkan—contohnya, jika anda menyimpan RM1,000 selama 12 bulan dengan keuntungan 5%, anda akan menerima RM1,050 setelah setahun. Perbezaan Utama antara FD dan FD-i Deposit Tetap (FD)Deposit Tetap-i (FD-i)Faedah vs Perkongsian Keuntungan Mendapat kadar faedah tetap ke atas deposit andaMenggunakan model perkongsian keuntunganPematuhan Syariah Tidak mematuhi syariah Mematuhi syariah Fleksibiliti Tempoh Pelbagai tempoh, memenuhi keutamaan pelaburan jangka pendek dan panjangMenyediakan pelbagai pilihan tempohPembahagian Keuntungan Pelaburan Pendapatan berdasarkan kadar faedah tetapPulangan berubah-ubah berdasarkan keuntungan daripada aktiviti yang mematuhi SyariahKadar Deposit Tetap/FD terkini untuk Januari 2025Bank Nama Produk Kadar Faedah Tempoh Promosi AllianceAlliance Personal Welcome Offer 3.80% p.a*1 Oktober 2024 - 31 Mac 2025CIMB CIMB eFixed Deposit-i (eFD-i)3.70% p.a*1 Oktober 2024 - 15 Januari 2025RHB - RHB Term Deposit- RHB e-Term Deposit- 3.70% p.a*- 3.80% p.a*3 Januari 2025 – 28 Februari 2025BSN - BSN Term Deposit-i- BSN SSP Platinum- 5.50% p.a*- 0.01% p.a*1 Oktober 2024 - 31 Disember 2024 MaybankMaybank e-Islamic Fixed Deposit-i (eIFD-i)- 3.70% p.a*- 3.65% p.a*28 Ogos 2024 - 31 Disember 2024OCBC Bank OCBC Fixed Deposit/-i promotion2.60% p.a* 10 Oktober 2024 - 31 Disember 20241. Alliance BankSumber : Alliance Bank Deposit Minimum: RM10,000Butiran dan syarat tawaran: Eksklusif untuk pemegang akaun baharu Alliance Bank; mesti didepositkan dalam tempoh 30 hari.2. CIMB BankSumber : CIMB Deposit Minimum: RM1,000Terma Utama: Pengguna mesti menggunakan Laman Web CIMB Clicks atau CIMB OCTO APP, dan memindahkan wang dari bank lain ke akaun CIMB Bank melalui FPX.3. RHB BankSumber: RHB Bank Deposit Minimum: RM5,000 (Pelanggan RHB) RM20,000 (Pelanggan RHB Premier)Tempoh 'Lock-In': 6 bulanTerma Utama: Ia boleh didepositkan melalui Aplikasi Perbankan Mudah Alih RHB atau Perbankan Dalam Talian RHB.4. BSNSumber: BSN Deposit Minimum: RM5,000Tempoh 'Lock-In': 6 bulanButiran Tawaran & Syarat: Jumlah penempatan minimum hanya untuk ‘Dana Baru’. Terbuka kepada pelanggan baru dan sedia ada Bank Simpanan Nasional (BSN).5.Maybank Sumber : MaybankDeposit Minimum: RM1,000Butiran tawaran dan syarat: Pengguna mesti membuat penempatan eFD melalui laman web Maybank2U.6. OCBC Bank Sumber : OCBC Bank Deposit Minimum: RM5,000Butiran tawaran dan syarat: Pengguna mesti ke kaunter OCBC Bank untuk memindahkan wang dari bank lain ke akaun OCBC Bank sebagai ‘Dana Baru’. Selain itu, pemindahan mesti diselesaikan dalam tempoh 7 hari.Sebagai kesimpulan, kadar faedah deposit tetap adalah pilihan yang bijak untuk mereka yang ingin melihat wang mereka berkembang dengan selamat. Dengan pelbagai pilihan kadar faedah yang ditawarkan oleh bank-bank terkemuka di Malaysia, anda pasti dapat mencari yang sesuai dengan keperluan pelaburan anda. Jadi, jangan tunggu lagi! Mulakan pelaburan anda hari ini dan saksikan bagaimana wang anda boleh bekerja lebih keras untuk anda. Siapa tahu, mungkin suatu hari nanti, anda akan terkejut dengan jumlah simpanan yang telah anda kumpulkan! Selamat melabur!Mencari pilihan pelaburan yang bijak? Berminat untuk mengembangkan aset kekayaan anda? Melabur dengan bijak untuk masa depan anda dengan kerjaya bersama kami - daftar di sini![hubspot portal="5699703" id="c063034a-f66d-41ab-881b-6e6a3f275c33" type="form"]Baca Selanjutnya: Kenaikan OPR – Kesan Kenaikan OPR kepada Bank dan Pengguna Potensi bank digital cetus perlumbaan mohon lesenPelaburan Menguntungkan di Malaysia! – No. 5 Paling Popular

Read more

Duti Setem Malaysia 2025: Kenaikan Kadar Duti dan Penalti Penyeteman Lewat

Duti Setem Malaysia 2025: Kenaikan Kadar Duti dan Penalti Penyeteman Lewat

Versi: CN, ENMulai 1 Januari 2025, Malaysia akan menyaksikan perubahan penting dalam struktur duti setem, yang akan memberi kesan kepada banyak transaksi, terutamanya dalam perjanjian sewa dan pajakan. Dengan pengenalan kadar baharu, penalti untuk kelewatan, serta perubahan dalam formula pengiraan, pembayar cukai perlu lebih berhati-hati dan memahami perubahan ini. Jika anda merancang untuk menyewa atau menyewakan hartanah, memahami struktur duti setem baharu 2025 adalah penting untuk mengelakkan kos tambahan!Apa yang Anda Perlu TahuApa itu Duti Setem untuk Kontrak Sewa?Kenaikan Terkini Kadar Duti SetemFormula Pengiraan Sewai. Kira Purata Sewa Tahunan (PST)ii. Kadar Berdasarkan Tempoh Sewaaniii. Kira Duti SetemPerubahan Penalti Penyeteman LewatCara kira penalti setem lewat yang baruApa itu Duti Setem untuk Kontrak Sewa? Duti setem untuk kontrak sewa adalah cukai yang perlu dibayar di Malaysia sebelum kontrak sewa menjadi sah dari segi undang-undang. Cukai ini dikenakan berdasarkan jumlah sewa yang dinyatakan dalam kontrak.LHDN (Lembaga Hasil Dalam Negeri) akan mengutip duti setem untuk memastikan kontrak sah dari segi undang-undang. Bayaran duti setem akan bergantung kepada jumlah sewa dan tempoh sewaan.Biasanya, duti setem dikira berdasarkan jumlah sewa tahunan. Setiap RM250 sewa dikenakan duti setem tertentu.Kontrak sewa perlu dicop oleh LHDN untuk menjadi sah dan digunakan sebagai bukti di mahkamah.Kenaikan Terkini Kadar Duti Setem Kadar duti setem akan meningkat berdasarkan skala baru yang lebih tinggi, bergantung kepada jumlah nilai sewa keseluruhan dan tempoh pajakan. Berikut merupakan kadar duti setem berdasarkan pindaan terkini Akta Setem yang akan berkuat kuasa bermula 1 Januari 2025. Sebelum 1 Januari 2025Tempoh Sewa/ Pajakan Selepas 1 Januari 2025RM1Tidak meelebihi 1 tahun RM1RM2Melebihi 1 tahun tetapi tidak melebihi 3 tahun RM3RM4Melebihi 3 tahun tetapi tidak melebihi 5 tahun RM5RM4Melebihi 5 tahun atau untuk tempoh tidak tentu RM7Duti setem dikira berdasarkan setiap RM250 atau sebahagian daripadanya, berdasarkan sewa purata dan pertimbangan lain untuk keseluruhan tahun. Formula Pengiraan Sewai. Kira Purata Sewa Tahunan (PST)S = Sewa bulanan T = Tempoh dalam bulan# = Nombor kadar berikutnya (untuk sewaan dengan kadar yang berlainan)ii. Kadar Berdasarkan Tempoh Sewaan Tempoh SewaKadar Sewa<1 tahunRM1 bagi setiap RM250 atau sebahagian daripada RM250>1-3 tahunRM3 bagi setiap RM250 atau sebahagian daripada RM250>2-5 tahunRM5 bagi setiap RM250 atau sebahagian daripada RM250>5 tahunRM7 bagi setiap RM250 atau sebahagian daripada RM250iii. Kira Duti SetemKaedah pengiraan duti setem baru tetap sama seperti sebelum ini. Berikut adalah cara mudah mengira caj duti setem untuk pajakan:Duti Setem = [(Purata Sewa Tahunan / 250) Dibundarkan ke atas bagi setiap 250] XKadar Berdasarkan Tempoh SewaanSebagai contoh, andaikan sewa bulanan anda ialah RM2,000 dan tempoh pajakan ialah 3 tahun , berikut ialah cara jumlah duti setem anda dikira:Sewa tahunan = RM2,000 x 12 = RM24,000Kadar duti setem = RM3 bagi setiap RM2501. RM24,000 / 250 = 962. Duti setem = 96 x RM3 = RM288Jadi, duti setem yang perlu dibayar adalam RM288Dua salinan kontrak pajakan mesti dibuat, satu untuk diberikan kepada tuan tanah dan satu lagi kepada penyewa.Bayaran setem untuk salinan adalah bayaran tetap sebanyak RM10.RM288 (asal) + RM10 (salinan) = RM298Oleh itu, jumlah duti setem yang perlu anda bayar ialah RM298. Perubahan Penalti Penyeteman LewatTempoh penyeteman yang ditetapkan masih kekal iaitu 30 hari dari tarikh perjanjian ditandatangani. Walau bagaimanapun, dengan perubahan baru pada kadar duti setem, penalti yang dikenakan bagi kelewatan pembayaran menjadi lebih signifikan. Penalti dikenakan berdasarkan tempoh kelewatan seperti berikut: AsalTempoh MasaSelepas 1 Januari 2025RM25 atau 5% daripada jumlah tertunggak duti setemKurang daripada 3 bulanRM50 atau 10% daripada jumlah tertunggak duti setemRM50 atau 10% daripada jumlah tertunggak duti setemLebih daripada 3 bulan tetapi kurang daripada 6 bulanRM100 atau 20% daripada jumlah tertunggak duti setemRM100 atau 20% daripada jumlah tertunggak duti setemLebih daripada 6 bulan atau lebihRM100 atau 20% daripada jumlah tertunggak duti setem*Amaun yang perlu dibayar hendaklah mengikut mana yang lebih tinggiCara kira penalti setem lewat yang baruSecara ringkas, anda perlu tahu jumlah duti setem kontrak pajakan terlebih dahulu. Hanya selepas itu, anda boleh kira jumlah denda yang perlu dibayar.Mengambil contoh yang baru disebutkan, dengan mengandaikan duti setem anda ialah RM298, penalti dikira seperti berikut:Sekiranya kelewatan penyeteman kurang daripada 3 bulan, penalti ialah RM50 atau 10% daripada jumlah tertunggak duti setem.Sekiranya kelewatan penyeteman lebih 3 bulan, penalti ialah RM100 atau 20% daripada jumlah tertunggak duti setem.Dalam kes ini, penalti adalah:1. RM298 x 10% = RM29.80, penalti RM50.LHDN akan menggunakan jumlah tertinggi, jadi denda akan dikenakan RM50.2. RM298 x 20% = 59.60, penalti RM100.LHDN akan menggunakan jumlah tertinggi, jadi denda akan dikenakan RM100.Secara keseluruhannya, pastikan anda memahami perubahan duti setem dan mematuhi tarikh pengecapan untuk mengelakkan penalti dan kos tambahan. Penyelesaian tepat pada waktunya akan membantu mengurangkan risiko denda dan memastikan kontrak sewa anda sah dari segi undang-undang.Jika anda bimbang tentang urusan hartanah, IQI adalah rakan yang boleh dipercayai!Kami menyediakan maklumat lengkap dan bantuan profesional untuk memastikan segala urusan hartanah anda berjalan lancar.Tinggalkan maklumat anda, pasukan kami akan menghubungi anda segera![hubspot portal="5699703" id="85ebae59-f425-419b-a59d-3531ad1df948" type="form"]Baca Selanjutnya:Laporan Pasaran Sewa Rumah Malaysia 2024: Kadar dan Jangkauan!Perjanjian Sewa Rumah di Malaysia: Yuran, duti setem dan banyak lagi!Keliru Cara Kira Duti Setem? 7 Perkara Asas Tentang Duti Setem Malaysia

Read more

Got a question?

We'd love to talk about how we can help you.

EN

EN